Challenging Q4 Dents Galane Gold’s Full Year Earnings

|

| Source: Galane Gold Website |

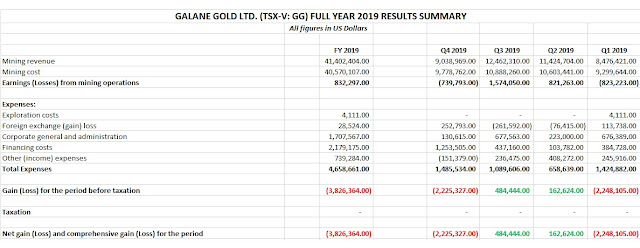

Galane Gold Ltd. (‘Galane Gold’, ‘Galane’ or ‘the Company’ (TSX-V: GG) today released its financials for the year ended 31st December 2019.

After promising Q2 and Q3 2019 earnings, this set of results can

best be described as underwhelming with net loss for the full year at USD 3.8M.

The main culprit for the poor financials was an unresolved SAG mill drive fault at its Mupane Gold Mine in Botswana in Q4 2019 as the company awaited long lead spares from overseas. This limited the milling capacity and resulted in the Company making a loss of USD

739,000 from mining operations for the quarter, in contrast to a profit of USD

1.6M in Q3 2019.

Financing costs for Q4 2019 was up nearly 2 times from the

preceding quarter. This was as a result of an increase in interest payments on

long term debt and a change in fair value of warrants denominated in foreign

currency.

A bright spot in the earnings was the precipitous drop in General

and Administrative expenses for the year by close to USD 1.3M.

CEO Nick Brodie made the following comments:

"In 2019, Mupane faced

operating challenges at the processing plant, but we managed to minimise the

financial effect by improving operating efficiencies and making positive

operating cash flows. This slight disappointment was offset by the progress made at Galaxy and the operations becoming cash positive was offset by the progress made at Galaxy and the operations becoming cash positive on a stand-alone basis towards the end of 2019 ahead of our internal targets."

|

| Source: TSX Venture Watch (Click to Enlarge) |

Challenges

Like most mining companies across the globe, Galane has not escaped

the impact of the COVID-19 pandemic. On March 26th 2020, South

Africa announced the country would be under lockdown for an initial 3-week period

as the nation aimed to restrict the spread of the coronavirus.

On expiry of the lockdown, an extension was issued until the end of April 2020, with the Government simultaneously announcing an easing of restrictions placed on mining operations. In that regard, on April 23 2020 Galane was informed that mining at Galaxy was designated as ‘essential’ and the mine would be allowed to operate at 50% of its capacity. South Africa is expected to transition from a lockdown to a curfew on 1st May 2020, in a sign of a further relaxation of stringent measures.

On expiry of the lockdown, an extension was issued until the end of April 2020, with the Government simultaneously announcing an easing of restrictions placed on mining operations. In that regard, on April 23 2020 Galane was informed that mining at Galaxy was designated as ‘essential’ and the mine would be allowed to operate at 50% of its capacity. South Africa is expected to transition from a lockdown to a curfew on 1st May 2020, in a sign of a further relaxation of stringent measures.

The lockdown has had an impact on Mupane as most of its critical

supplies are sourced from South Africa. Similarly, Mupane’s off-taker notified

Galane that they would be unable to ship their gold doré during the period.

Botswana subsequently began its own 28-day lockdown on 2nd April

2020 (recently extended to 7th May 2020 and thereafter to be eased

in phases). Though Mupane was deemed to be an essential operation, newly instituted

protocols to manage the potential spread of COVID-19 resulted in the

restriction of production for the month April.

The Company aims to resume full production at Mupane this

week, while it expects to recommence operations at Galaxy on or before 4th

May 2020.

Delays arising as a result of the pandemic will have an impact on timelines for the commissioning of the new plant at Galaxy initially slated for May 2020. The commissioning is likely to be pushed back to Q3 2020. The publication of an independent Preliminary Economic Assessment supporting Phase 2 expansion of Galaxy to an annual production of 60,000 ounces of gold is also expected thereabouts.

While management hopes to make up for the shortfall in production occasioned by the pandemic during the year, the Company believes the impact of COVID-19 could be material and it has subsequently withdrawn all previously issued 2020 annual guidance.

Delays arising as a result of the pandemic will have an impact on timelines for the commissioning of the new plant at Galaxy initially slated for May 2020. The commissioning is likely to be pushed back to Q3 2020. The publication of an independent Preliminary Economic Assessment supporting Phase 2 expansion of Galaxy to an annual production of 60,000 ounces of gold is also expected thereabouts.

While management hopes to make up for the shortfall in production occasioned by the pandemic during the year, the Company believes the impact of COVID-19 could be material and it has subsequently withdrawn all previously issued 2020 annual guidance.

Positives

Gold Price

In February, Chairman Ravi Sood weighed in on the fundamentals

underpinning the rally in gold. He

mentioned that the over the past few months Galane had witnessed an explosion of

interest from parties seeking gold offtakes.

Ravi went on to state that with gold at its highest level in 7 years, Galane was churning

significant levels of cash flow and the financial

position the company finds itself in provides "huge opportunities" to capitalise on the acquisition of companies that are trading at

depressed valuations but with sleeper assets that can be brought

into production.

Paying Down Debt

The elevated gold price in the second half of 2019 enabled

Galane to pay down USD 3.4M in debt (principal excluding interest).

CEO Nick Brodie is on recent record for stating that with the Company having budgeted for a 2020 gold price of USD 1400 an

ounce, a price of USD 1600 coupled with production of 45,000 ounces of gold would result in an additional USD 9M

in cash flow than initially forecast (scroll below fro video). Gold has since shot up to USD 1700 an

ounce.

This potential revenue will not only ensure that Galane has no problems in meeting

its debt obligations, but that the Company's continuing expansion remains self-funded.

It is however important to note that both interviews were conducted prior to the impact of COVID-19 being felt on their operations. Still, their sentiments provide an accurate picture of what the future holds for the Company once it returns to full operations.

Renegotiation of Payment of Botswana Royalties

Galane's previous

agreement with the Government of Botswana in early 2018 stipulated that deferred royalties of USD 8.4M was to be

settled by paying USD 1.4M between March 2018 and December 2019 (already paid). The balance including interest was to be settled by making monthly instalments of USD 600,000 for the entirety of 2020.

While management projects that the current gold price would allow the Company to repay the deferred royalties consistent with the payment schedule agreed with the Government of Botswana, the company has entered into discussions to reschedule the repayments. In the interim, Galane has been repaying USD 200,000 per month as it awaits to conclude talks.

While management projects that the current gold price would allow the Company to repay the deferred royalties consistent with the payment schedule agreed with the Government of Botswana, the company has entered into discussions to reschedule the repayments. In the interim, Galane has been repaying USD 200,000 per month as it awaits to conclude talks.

Warrant Exercises

Galane received USD 851,000 in December 2019 from the exercise

of warrants relating to a USD 2.7M private placement carried out in late 2018

to fund the restart of Galaxy. The Company expects to receive an additional USD

1.1M from the exercise of warrants at an exercise price of CAD 0.05. Though the warrants expire on 1st October 2020, Galane maintains the right

to accelerate their exercise should the share price trade above

CAD 0.20 for 10 consecutive days at the TSX Venture Exchange.

Funds received from these exercises will boost the company’s working

capital position.

Ramp up of production

at Galaxy

Galane plans to produce 26,000 ounces of gold from Galaxy in

2021 and 60,000 the year after. Incorporating its production from Mupane, Galane

will have a production profile of 90,000 ounces of gold per annum in 2022, nearly triple its current production.

Potential

Acquisitions

The Company has built a strong management team with competence

in projects involving underground mines with complex metallurgies. Galane's

medium term strategy is therefore to have a pipeline of such

projects to put management's skill set to use

Brodie believes similar projects are currently undervalued by

the market and Galane is able to make acquisitions and put them into production.

Takeover Candidate?

When pressed on whether he thinks Galane would be an

attractive takeover target, Brodie countered that he is just focused on building

the Company into a bigger outfit. Investors will be pleased to hear the CEO rule out any takeover while Galane is trading at such a low valuation.

He, however, went on to state that he believes the Company is significantly undervalued by the market and concedes that companies like Pan African Resources (LON: PAF) - a 170,000 ounce of gold per year producer neighbouring Galane in South Africa currently trading at the equivalent of CAD 475M, and B2Gold (TSX: BTO) - their CAD 7.7B exploration partner in Botswana, might find Galane to be "interesting".

He, however, went on to state that he believes the Company is significantly undervalued by the market and concedes that companies like Pan African Resources (LON: PAF) - a 170,000 ounce of gold per year producer neighbouring Galane in South Africa currently trading at the equivalent of CAD 475M, and B2Gold (TSX: BTO) - their CAD 7.7B exploration partner in Botswana, might find Galane to be "interesting".

Galane today closed at CAD 0.095, down 9.5%, and is trading at a market capitalisation of CAD 21.2M. With gold prices for the year to date averaging USD 1,685 an ounce, nearly USD 300 higher than the average price for 2019, the Company should have vastly improved earnings for 2020.

I therefore maintain my 1H 2020 target price of CAD 0.25 as Galane maintains excellent re-rating potential with several near-term catalysts on the horizon.

It will attract the market’s attention, sooner rather than later.

ALL THE BEST

Disclaimer: I have a position in Galane Gold. This article solely expresses my opinion. I have not received any compensation for this article.

Comments

Post a Comment